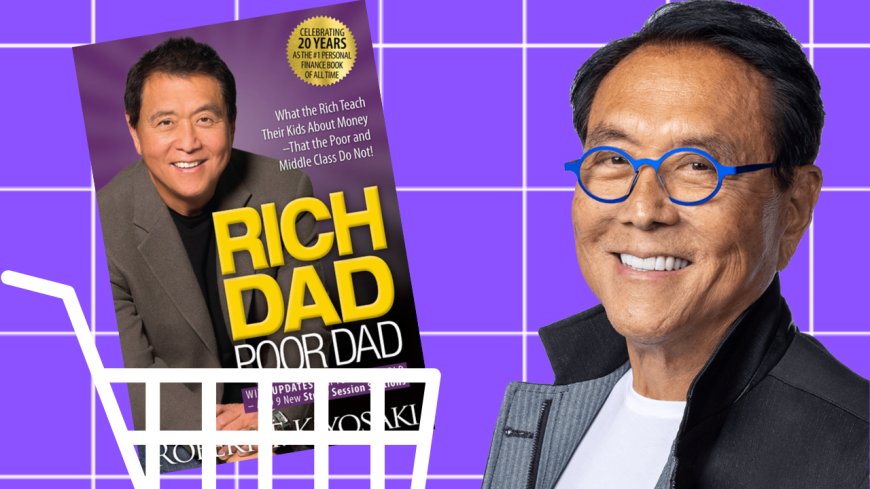

Lessons from "Rich Dad Poor Dad" – A Fresh Perspective

Discover key financial lessons from 'Rich Dad Poor Dad' and learn how to build wealth through smart investments, passive income, and financial literacy. Unlock your path to financial freedom today!

"Rich Dad Poor Dad" the bestselling book by Robert Kiyosaki, has transformed millions of lives by challenging conventional wisdom about money. At its core, the book revolves around contrasting financial philosophies from two father figures in Kiyosaki's life: his own educated but financially struggling biological father (Poor Dad) and his friend’s entrepreneurial and financially astute father (Rich Dad). Let’s delve into the key takeaways and explore how you can apply them in a modern context.

1. The Mindset Shift: Assets vs. Liabilities

One of the foundational lessons of the book is distinguishing between assets and liabilities. An asset is something that puts money in your pocket, while a liability takes money out. For example, many people consider a house they live in an asset, but Kiyosaki argues it’s often a liability due to ongoing expenses like mortgages, maintenance, and taxes.

Modern Takeaway:

Think beyond traditional investments. In today's digital age, building online assets like e-commerce stores, blogs, or apps can generate passive income streams. Prioritize creating or acquiring assets that align with your skills and interests.

2. Financial Education Is Key

Kiyosaki emphasizes that schools focus on academic and professional education but rarely teach financial literacy. His "Rich Dad" advocated learning about money, investing, and understanding market trends to escape the rat race.

Modern Takeaway:

Leverage free or affordable resources like online courses, financial blogs, and podcasts. Platforms like Coursera, Udemy, or YouTube offer excellent insights into budgeting, investing, and entrepreneurship. Financial literacy is more accessible now than ever—use it to your advantage.

3. Work to Learn, Not Just to Earn

"Poor Dad" believed in working hard for a paycheck, while "Rich Dad" stressed the importance of working to acquire new skills. This mindset encourages adaptability and growth, ensuring long-term financial security.

Modern Takeaway:

Consider jobs or side gigs that teach valuable skills like coding, marketing, or sales, even if they don’t pay as much initially. These skills can become the foundation for your entrepreneurial ventures or higher-paying opportunities in the future.

4. The Power of Passive Income

The ultimate goal, according to "Rich Dad," is financial freedom, achieved when your passive income exceeds your expenses. This could come from real estate, stocks, royalties, or businesses that require minimal daily involvement.

Modern Takeaway:

Today, you have countless ways to create passive income. Real estate crowdfunding, dividend-paying stocks, digital products, and affiliate marketing are just a few examples. Start small, automate where possible, and reinvest to grow your streams of income.

5. Embrace Risk, but Be Informed

"Rich Dad" highlighted the importance of taking calculated risks, while "Poor Dad" preferred the safety of a steady paycheck. Kiyosaki argues that financial growth often requires stepping out of your comfort zone.

Modern Takeaway:

With access to data and tools, taking informed risks is easier than ever. Use apps like Robinhood for stock trading, Fundrise for real estate, or Skillshare to develop side-hustle expertise. Combine knowledge with action to make smarter financial decisions.

6. Networking and Mentorship

Kiyosaki attributes much of his financial acumen to learning from his "Rich Dad" and other mentors. Surrounding yourself with like-minded individuals can significantly influence your success.

Modern Takeaway:

Join online communities, attend webinars, and engage with professional networks like LinkedIn. Mentorship doesn’t always have to be face-to-face; many successful individuals share their expertise through blogs, courses, and social media.

Final Thoughts

"Rich Dad Poor Dad" isn’t just a book about money; it’s a guide to rethinking life’s priorities. By focusing on financial education, investing in assets, and cultivating a growth mindset, you can rewrite your financial story. Remember, the first step to financial freedom is not just earning more but thinking differently about how you earn and spend. Start today, and let the lessons of "Rich Dad Poor Dad" guide you to a wealthier future.

What's Your Reaction?

![[(Complete] List of Official Uphold®© Support™ Customer™ Service Contact Numbers in USA](https://updatesonproperty.com/uploads/images/202508/image_140x98_68ad4e7b9f1c5.jpg)